UK NHS AW8P 2012 free printable template

Show details

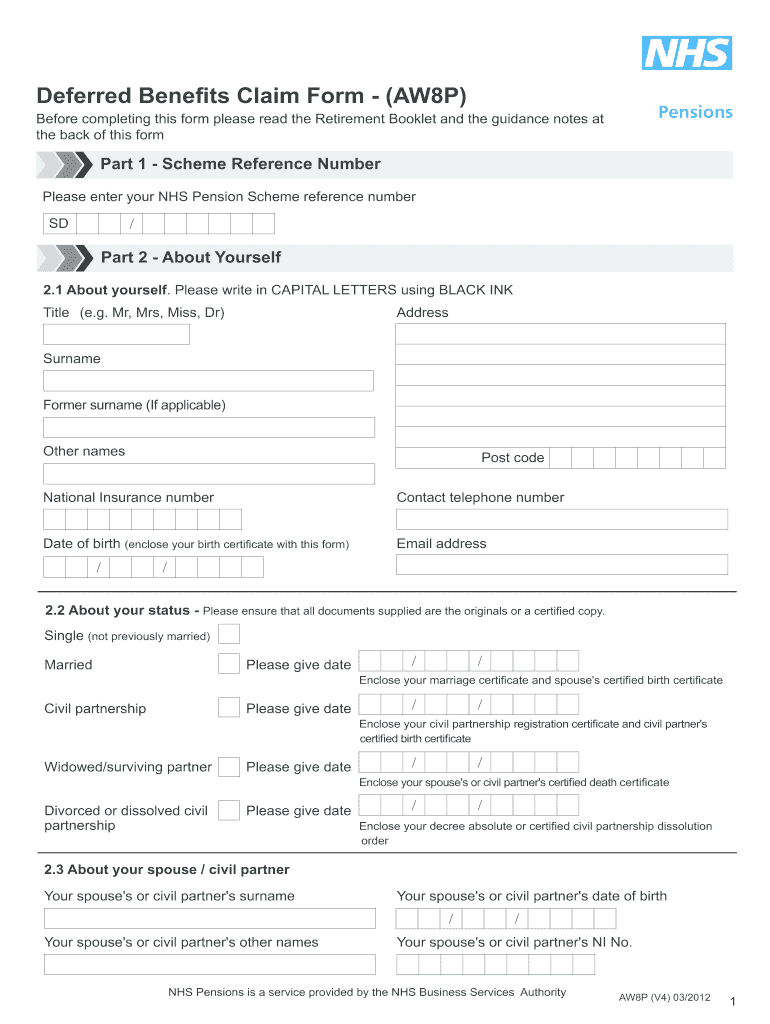

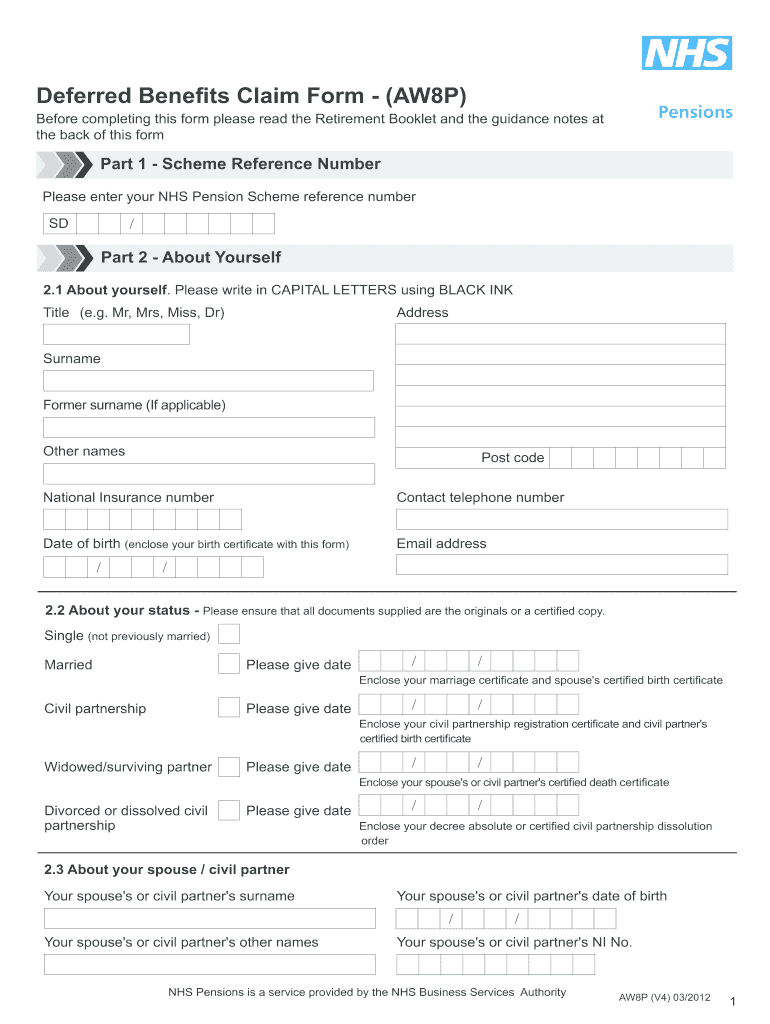

Deferred Benefits Claim Form - AW8P Before completing this form please read the Retirement Booklet and the guidance notes at the back of this form Part 1 - Scheme Reference Number Please enter your NHS Pension Scheme reference number / SD Part 2 - About Yourself 2. 3 About your spouse / civil partner Your spouse s or civil partner s surname NHS Pensions is a service provided by the NHS Business Services Authority AW8P V4 03/2012 2. Dependent on y...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your aw8pform form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your aw8pform form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing aw8pform online

To use our professional PDF editor, follow these steps:

1

Sign into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit aw8pform. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

UK NHS AW8P Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out aw8pform

How to fill out aw8pform:

01

Begin by obtaining the aw8pform, which is available on the official website of the Internal Revenue Service (IRS).

02

Carefully read the instructions provided with the form to understand the requirements and gather the necessary information.

03

Start by filling out your name, Social Security number, and address in the designated sections of the form.

04

Proceed to indicate your tax classification, which can be obtained from the IRS.

05

If you are exempt from backup withholding, make sure to provide the required certification.

06

Enter your country of citizenship and if applicable, your foreign tax identification number.

07

Complete the section on claiming a reduced rate of withholding, if applicable.

08

Sign and date the form.

09

Retain a copy of the completed form for your records.

10

Submit the form to the appropriate withholding agent or payer.

Who needs aw8pform:

01

Individuals or entities who receive payments subject to U.S. federal income tax withholding.

02

Non-U.S. persons who want to claim tax treaty benefits and reduce their withholding tax rate.

03

Payees who are exempt from backup withholding tax.

Note: It is always recommended to consult with a tax professional or refer to the IRS website for specific guidance on filling out the aw8pform based on your individual circumstances.

Fill form : Try Risk Free

People Also Ask about aw8pform

How do I withdraw from NHS pension form?

What is a AW8P form?

What happens to my NHS Pension if I move abroad?

What happens to my NHS Pension if I leave the UK?

Where can I get AW8P form?

How do I claim my NHS superannuation?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is aw8pform?

There is limited information available about "aw8pform," and it is unclear what specific context or meaning you are referring to. It is possible that it could be a typo or a specific term/code related to a particular system, website, or application. Further clarification or details would be necessary to provide a more accurate answer.

Who is required to file aw8pform?

The Form W-8BEN-E is generally filed by foreign entities to provide information about their foreign status and to claim beneficial tax treaty benefits, if applicable. However, it is important to seek professional advice from a tax expert or consult the IRS guidelines for specific circumstances and regulations surrounding the use of Form W-8BEN-E.

How to fill out aw8pform?

To fill out an AW8P (Withholding Certificate for Pension or Annuity Payments) form, you need the following information:

1. Personal information: Enter your name, address, and social security number or tax identification number.

2. Determine your filing status: Mark the appropriate box indicating your filing status (single, married, etc.)

3. Claiming exemption: If you are exempt from federal income tax withholding, write "Exempt" in the space provided and skip to the signature section. Otherwise, proceed to the next step.

4. Number of allowances: Determine the number of allowances you wish to claim by referring to the personal allowances worksheet provided with the form. Enter the total number of allowances you are claiming in the appropriate box.

5. Additional withholding: If you want an additional amount to be withheld from each pension or annuity payment, enter the desired amount in the space provided.

6. Certification and signature: Read the certification statement carefully, sign, and date the form. If you are completing the form on behalf of someone else, you must provide your information as well.

7. Submitting the form: Once complete, submit the form to the payer of your pension or annuity payments, preferably at the address specified by them.

Note: It is recommended to consult with a tax professional or refer to the IRS instructions for the AW8P form (available online) for specific guidance related to your tax situation.

What information must be reported on aw8pform?

The AW8P form, also known as the Agreement to Withhold Tax on Income Not Effectively Connected with a U.S. Trade or Business, is used by nonresident aliens to report their income to the Internal Revenue Service (IRS). The form contains the following required information:

1. Personal Information: The individual's name, address, taxpayer identification number (TIN), date of birth, and country of citizenship.

2. Employer Information: The name, address, and employer identification number (EIN) of the employer or payer from whom the income is received.

3. Income Information: Details of the income received from U.S. sources, including the type of income (e.g., wages, rents, dividends) and the amount earned. This should be reported for each specific income source separately.

4. Treaty Claim: If the individual is eligible for a tax treaty benefit, they must indicate the country of residence and the applicable tax treaty article or provision that supports their claim.

5. Withholding Election: The individual must choose whether they want a flat 30% tax withheld on the income or if they prefer to use a tax treaty rate, and provide the necessary details if using the treaty rate.

6. Certification: The individual must certify, under penalties of perjury, that the information provided is true and correct.

It is important to note that the AW8P form should be submitted to the withholding agent, who is usually the individual's employer or payer. The employer or payer will then use the information provided on the form to determine the appropriate amount of tax to withhold from the individual's income.

What is the penalty for the late filing of aw8pform?

The penalty for the late filing of an AW8P form can vary depending on the jurisdiction and the specific circumstances. Generally, late filing penalties can range from fines to interest charges on the unpaid taxes. It is advisable to consult with the relevant tax authority or a tax professional to determine the specific penalty for late filing in your jurisdiction.

How do I make edits in aw8pform without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your aw8pform, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How can I fill out aw8pform on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your aw8pform. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Can I edit aw8pform on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute aw8pform from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your aw8pform online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.